The Beef Enterprise Strengthening and Transformation (BEST) project is promoting access, delivery and usage of retail financial services among smallholder farmers in a transparent, inclusive, and equitable fashion. The project started with a research study to understand the demand and supply side of the evolving financial landscape. This has resulted in a shift from a narrow focus on the financial institutions and their performance to a much broader focus on clients i.e. understanding their behaviour, financial service needs, and how various providers can better meet these needs.

This recognition (supported by significantly better data and more robust research under the project) that outreach and, perhaps more important, impact have not been as good as expected has pushed the project to develop a “Tripartite value chain financing model” for smallholders with guaranteed support throughout the value chain. The tripartite model allows farmers access to feed, which they need to add value to their cattle, the feed supplier with business for which he gets paid up front, the off-taker with good quality cattle for his market, and the financier with guaranteed loan repayment by the off-taker on behalf of the farmers.

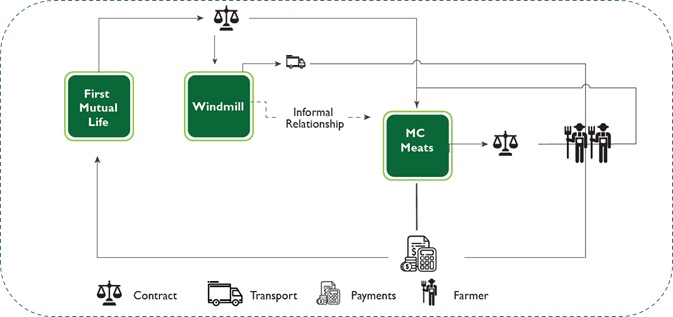

Under the Tripartite Financing Model, BEST brought in First Mutual Microfinance (FML) as the financier, Windmill Private Limited as the input supplier and MC Meats as the off-taker, under a common agreement to work with smallholder cattle farmers who wanted to pen fatten their cattle.

Tripartite Financing Model

In Chiredzi and Buhera districts, 72 farmers accessed loans from First Mutual Microfinance (FML) to finance pen fattening. First Mutual Microfinance made advance payments to the stock feed supplier (Windmill).

This advance is taken as a loan to farmers as they have signed loan contracts with the lender. Windmill then delivered the stock feed to farmers for pen fattening under the MC Meats feeder finance scheme.

On delivery of fattened cattle to MC Meats, the off taker deducted the loan repayment to FML and made a lump sum repayment on behalf of the farmers. The net balance was paid to cattle producers.

The cattle producers in the two districts received a total of 118 tonnes of stock feed for a 45-day pen fattening cycle from November through December to target slaughter at peak demand for meat during the festive season.

A total of 223 cattle belonging to 72 farmers went through the pen fattening cycles at Cattle Business Centres (CBCs).

Total sale value of cattle was US$117,002, cost of feed was US$35,270, so net income realized was US$ 81,732. Thus the average sale value/head was US$525, and farmers received an average of US$ 366/ head after feed cost deductions, compared with average pre-induction values of < US$150 - 200/head offered by middlemen.

Benefits derived from the Tripartite Model

- Creation of linkages between value chain actors (cattle producers; financiers, off-takers)

- Increased private sector footprint in Zimbabwe rural districts

- Breaking barriers (small holder farmers are not bankable)

- Reduction in transaction costs

- Elimination of the “middlemen” who offered low prices to farmers